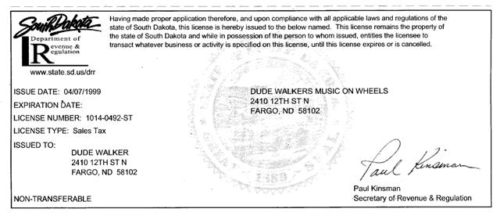

SD Tax License

South Dakota Tax License

Business Tax Statutes – Title 10

10-45-4. Tax on receipts from business services. There is hereby imposed a tax at the same rate as that imposed upon sales of tangible personal property in this state upon the gross receipts of any person from the engaging or continuing in the practice of any business in which a service is rendered. Any service as defined by § 10-45-4.1 shall be taxable, unless the service is specifically exempt from the provisions of this chapter.

10-45-4.1. Services subject to taxation. “Service” means all activities engaged in for other persons for a fee, retainer, commission, or other monetary charge, which activities involve predominantly the performance of a service as distinguished from selling property. In determining what is a service, the intended use, principal objective or ultimate objective of the contracting parties shall not be controlling. For the purposes of this chapter services rendered by an employee for his employer are not taxable.

![Twitter@Dude_Walker [Follow Button] Dude Walker Twitter Follow Button](https://dudewalker.org/wp-content/uploads/2010/12/dudewalker-TwitterButton-200x32.png)